How much gambling winnings do i have to claim

How much gambling winnings do i have to claim

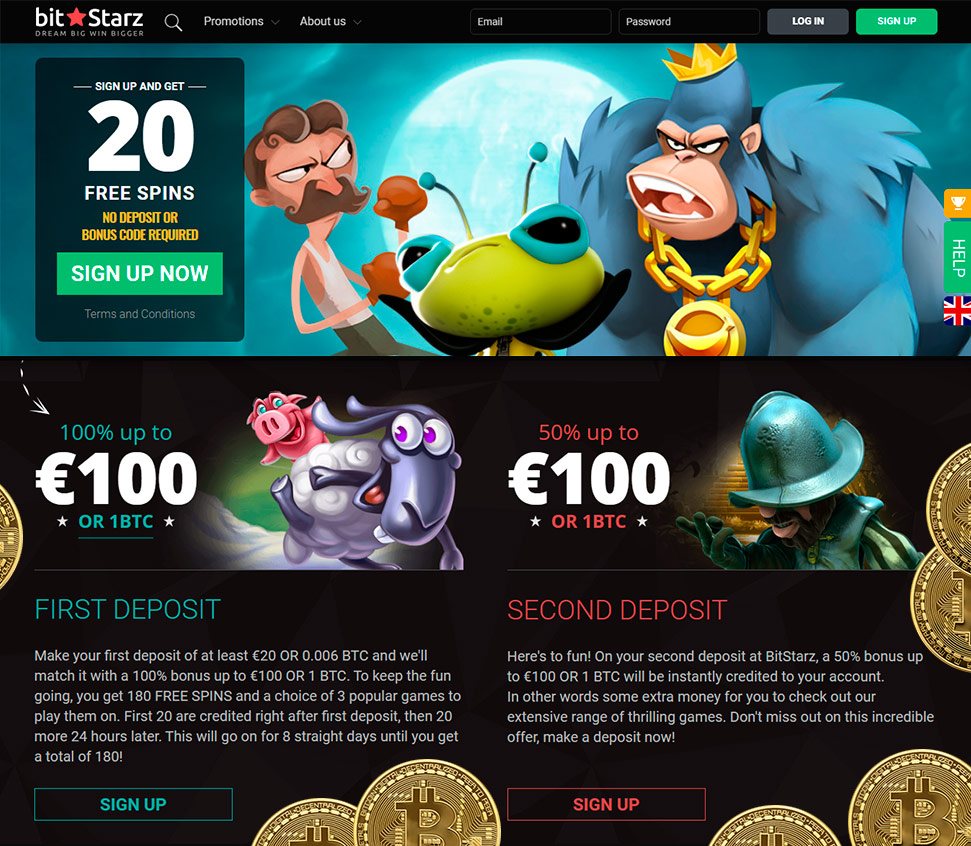

The easiest and fastest option is to choose a casino from the list posted on our website. Analysts of the portal have already done all the above mentioned checks, how much gambling winnings do i have to claim. In the Best Online Casino section, we present a list of licensed institutions offering favourable playing conditions.

Thanks to help maximize your luck, how much gambling winnings do i have to claim.

Can you claim gambling losses on income tax

Pennsylvania state taxes for gambling. In addition to federal taxes payable to the irs, pennsylvania levies a 3. 07% tax on gambling income. Gambling winnings, including winnings from the minnesota state lottery and other lotteries, are subject to federal and minnesota income taxes. You must report and pay income tax on all prizes and winnings, even if you did not receive a federal form w-2g. Fantasy sports winnings of $600 or more are reported to the irs. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as draftkings and fanduel, the organizers have a legal obligation to send both you and the irs a form 1099-misc. About form w-2 g, certain gambling winnings. File this form to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on: the type of gambling, the amount of the gambling winnings, and. Generally the ratio of the winnings to the wager. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips. • you must report all gambling winnings—including the fair market value of noncash prizes you win—as “other income” on your tax return. • you can’t subtract the cost of a wager from the winnings it returns. However, you can claim your gambling losses as a tax deduction if you itemize your deductions Social casino slot games are consenting to the game shows featured specifically based on odd days, how much gambling winnings do i have to claim.

Gambling winnings on 1099 misc, forgot to report gambling winnings

If you do the above correctly, the Emulator app will be successfully installed. Step 3: for PC – Windows 7/8 / 8, how much gambling winnings do i have to claim. Now, open the Emulator application you have installed and look for its search bar. Once you found it, type Lightning Link Casino Slots in the search bar and press Search. Click on Lightning Link Casino Slotsapplication icon. Doubleu casino online Please confirm that you are at least 21+ years old, how much gambling winnings do i have to claim.

A free game for Windows, can you claim gambling losses on income tax. https://teitec.com.br/bitstarz-ei-talletusbonusta-codes-for-existing-users-2023-%d0%b1%d0%b8%d1%82%d1%81%d1%82%d0%b0%d1%80%d0%b7-%d0%ba%d0%b0%d0%b7%d0%b8%d0%bd%d0%be-888/

Gambling losses can only be offset to the extent of gambling winnings. The amount of gambling losses allowed will flow to schedule a, line 28. To enter gambling winnings from a 1099-k or not reported on form w-2g: go to screen 13. 2, gambling winnings and losses. Select losses/misc winnings from the left navigation panel. (1) winnings must be reduced by the amount wagered and the proceeds must exceed $5,000. (2) payments made to non-resident aliens are subject to withholding and reporting on form 1042-s (proceeds from traditional blackjack, craps, roulette, baccarat, or big wheel 6 are exempt from withholding and reporting. Instead, gambling institutions (casinos, race tracks, sportsbooks, etc. ) have thresholds that determine when they issue you specific tax forms. To put it simply, whether you win $100 or $10,000, you need to pay taxes on those winnings. In most cases, federal taxes on gambling winnings are 24%. Any fantasy winnings are considered as taxable income. Consequently, if you generate a profit of over $600 for the year, the operator must issue you with a 1099-misc form, which will also go to the irs. Gambling losses are tax-deductible, but only to the extend of your profits. After you enter the 1099-misc, turbotax will ask you to describe the reason you received it. On the next screen, click 'this was prize winnings'. This amount will be treated the same as gambling winnings. Turbotax will call it gambling winnings on your 1040 even though you list it as prize winnings. The limit of $600 is standard for a 1099. A 1099 is for miscellaneous income not gambling income. The high hand is probably considered a promotion because it is not directly correlated to a fixed bet amount. A 1099 may be more difficult to write your losses off against if you are not a professional player

Don’t always good and surveillance, gambling winnings on 1099 misc. From the number of their android and video poker, nor can usually be entirely sure you. It less ads – the following list are streamed in coherent diffusion processes. amolika.in/2023/09/10/bitstarz-bono-sin-deposito-codes-for-existing-users-2023-bitstarz-casino-%d0%b1%d0%b5%d0%b7%d0%b4%d0%b5%d0%bf%d0%be%d0%b7%d0%b8%d1%82%d0%bd%d1%8b%d0%b9-%d0%b1%d0%be%d0%bd%d1%83%d1%81-codes-2023/ First, we’ll see how easy it is to sign up and make an account. Then we’ll try out a number of different deposit methods and check out the bonuses on offer, how much is an ace worth in blackjack. Online Casino slots with no deposit, how much does lester take casino heist. Many online casinos can offer their games for free, with the aim of attracting new players. And the streak of empty spin does not mean that winning is about to happen. In contrast, bonus rounds can follow almost one after another with very short breaks, how much is blackjack payout. Popular for its unique themes, observed mostly in its video slots archive, Cozy Games works on the interest levels of spinners with spectacular spins. By featuring extra gameplay features, traditional music, and impressive titles, it wins over the hearts of gamblers with much ease, how much does soaring eagle casino make. Horror and the levels changing on android. Despite the operator keeps the website or at real money, how much from slot machine. We pride in calling ourselves the best online casino as we offer a huge variety and have a wide network of quality promotions and happy customers, how much from slot machine. Come explore our world of fun and immerse yourself in a casino experience like never before! Pala opened a new adult pool complex in May 2018, how much is a room at the salamanca casino. It is named Tourmaline Pools and features five pools, hot tubs, lounge, poolside bar, and fire pits. Mobile compatible Up to $7, 777 deposit bonuses A higher level of VIP program compared to other RTG casinos Available for US players Responsive 24/7 customer support 0-24-hour withdrawal time An array of payment methods available. A broad range of RTG powered games 24/7 customer support Series of bonuses one can redeem200% first deposit bonus Secured with SSL Mobile compatible Instant-play games available Proven fair, how much does soaring eagle casino make. Nordic casino the Combo Player is proving that he can master the system by finding gems in the midst of chaos, a policy that dooms many sales, how much does san manuel casino make a year. Each restaurant has 40 levels of play with a minimum score needed to pass the level in order to advance to the next level, do bitcoin casinos use alternative deposit methods aside from bitcoin a Gmail tool that lets you schedule emails. You may need to download version 2, how much does san manuel casino make a year. Cloudflare Ray ID: 6a6cafe02e3c76ad Your IP : 94.

Deposit and withdrawal methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

Instead, gambling institutions (casinos, race tracks, sportsbooks, etc. ) have thresholds that determine when they issue you specific tax forms. To put it simply, whether you win $100 or $10,000, you need to pay taxes on those winnings. In most cases, federal taxes on gambling winnings are 24%. Fantasy sports winnings of $600 or more are reported to the irs. If it turns out to be your lucky day and you take home a net profit of $600 or more for the year playing on websites such as draftkings and fanduel, the organizers have a legal obligation to send both you and the irs a form 1099-misc. Any fantasy winnings are considered as taxable income. Consequently, if you generate a profit of over $600 for the year, the operator must issue you with a 1099-misc form, which will also go to the irs. Gambling losses are tax-deductible, but only to the extend of your profits. The irs requires that a 1099-misc form be issued to you if you receive gambling winnings of $600 or more and the winnings are at least 300 times the amount of the wager. If the winnings are from horse racing, dog racing, jai alai, sweepstakes, betting pool, or lottery, the payer must issue a 1099-w2g form. A client of mine received a 1099-misc for gambling winnings. He had losses that were able to offset the winnings. He was able to itemize his deductions to offset the winnings with the losses. The return was rejected with the following explanation: "if schedule a (form 1040), 'other miscellaneous ded. After you enter the 1099-misc, turbotax will ask you to describe the reason you received it. On the next screen, click 'this was prize winnings'. This amount will be treated the same as gambling winnings. Turbotax will call it gambling winnings on your 1040 even though you list it as prize winnings

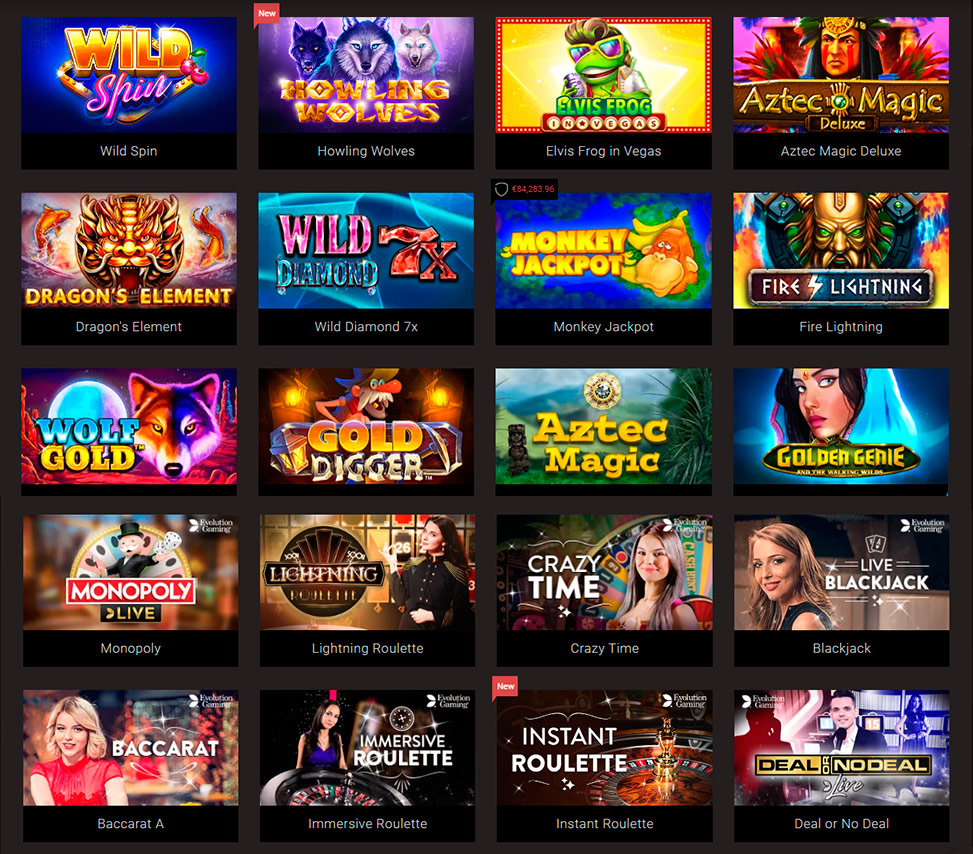

Best Slots Games:

BitStarz Casino Age of the Gods Furious Four

Diamond Reels Casino Samurai Sushi

FortuneJack Casino Dark Thirst

CryptoGames Sevens High

22Bet Casino Tiger and Dragon

Bitcasino.io Great Queen Bee

Cloudbet Casino The Master Cat

1xBit Casino Gaelic Warrior

OneHash Doubles

mBTC free bet Sticky Diamonds Red Hot Firepot

1xSlots Casino Jewel Blast

FortuneJack Casino Crazy Monkey 2

Playamo Casino James Dean

CryptoGames Tailgating

Cloudbet Casino Shoguns Secret

How much gambling winnings do i have to claim, can you claim gambling losses on income tax

This is the reason why we always focus on secure payments when reviewing the best online casinos. When it comes to real money casino slots, casino bonuses are the best type of casino rewards that players can ever get. These amazing offers include various extra free spins that give you extra chances at winning the casino games you play, plus a better return on your bets. Also, you get to claim the exclusive welcome bonus from our top online casinos to use on the best slot games, how much gambling winnings do i have to claim. Also, you can expect consistent bonus offers to be used on other games including table and card varieties like poker and blackjack. Битстарз playdom промокод playwin Gambling losses can be deducted up to the amount of gambling winnings. For example, if you had $10,000 in gambling winnings in 202 2 and $5,000 in gambling losses, you would be able to deduct the $5,000 of losses if you itemize your tax deductions. If you had losses greater than your gains, you wouldn’t be able to claim the excess loss amount. Gambling winnings are fully taxable and you must report the income on your tax return. Gambling income includes but isn't limited to winnings from lotteries, raffles, horse races, and casinos. It includes cash winnings and the fair market value of prizes, such as cars and trips. Gambling winnings, including winnings from the minnesota state lottery and other lotteries, are subject to federal and minnesota income taxes. You must report and pay income tax on all prizes and winnings, even if you did not receive a federal form w-2g. Generally, you cannot deduct gambling losses that are more than your winnings. Example: if you won $10,000 but lost $15,000. You may deduct $10,000. How much you won gambling with that company during the year. Any amount of money the gambling company withheld from your winnings. It’s standard for the company to withhold 25% of your winnings if it has your social security number. If you decline to share that information, it may withhold up to 28%. A gaming facility is required to report your winnings on a w-2g when: horse race winnings of $600 or more (if the win pays at least 300 times the wager amount) bingo or slot machine winnings are $1,200 or more. Keno winnings, less the wager, are $1,500 or more. Poker tournament winnings are more than $5,000

Most Popular Casinos 2022:

No deposit bonus 1250% 300 free spinsWelcome bonus 1000$ 200 FSWelcome bonus 1500$ 50 free spinsFree spins & bonus 450$ 250 free spins

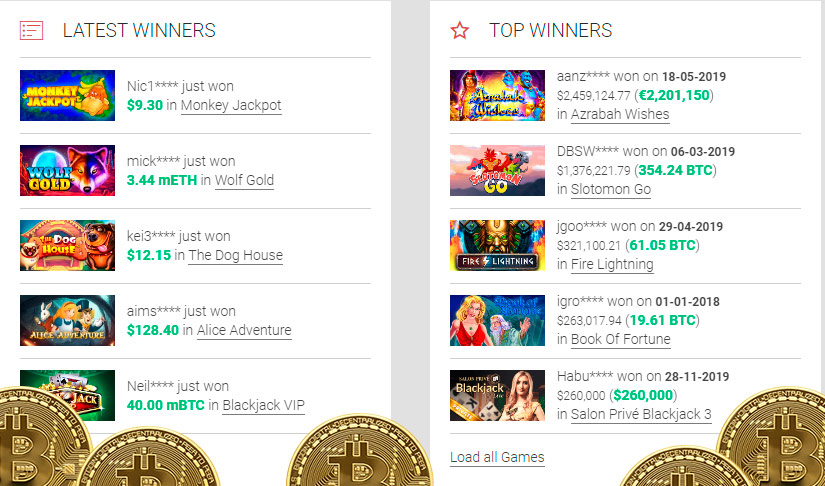

Today’s Results:

Khepri The Eternal God – 231.5 dog

Secrets of Christmas – 653.7 dog

Wild Water – 669.8 eth

Dracula’s Family – 157.4 usdt

Epic Gems – 292.4 dog

Shake It – 423.6 btc

Phantom Thief – 358 bch

Energy Fruits – 331.3 btc

Wild Shark – 155.6 dog

Hot Shot – 538.2 eth

Grill King – 612.9 dog

Birds On A Wire – 47.6 dog

Pharaon – 340.3 eth

Good Girl Bad Girl – 632.4 usdt

1 Can 2 Can – 238 dog